Everywhere you turn, it seems there’s a new process, a new technology, and a new consumer preference that is “going digital.” More and more cardholders around the globe are preferring, and expecting, a digital-first payment experience. Because of the technology behind it all, IT professionals are at the center of this digital transformation. The pandemic accelerated an awareness of and migration to contactless and digital payments, and the payments ecosystem is now one of the fastest movers when it comes to digitization.

51% of U.S. cardholders state that their mobile banking app is their preferred method to engage with their financial institution. This data shows us that customers are looking for seamless, digital-first payment and card management experiences. With that data guiding us, it’s clear an elevated and enriched issuance and payment enablement process is now the gold standard to meet the demand of cardholders.

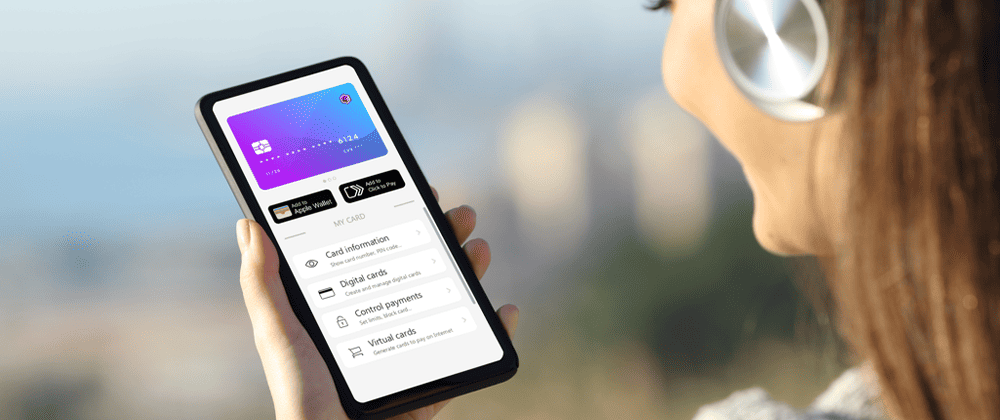

Bridging Physical and Digital Experiences for Cardholders

That gold standard experience – providing a compelling, seamless digital card and payment experience – can help a bank to achieve top-of-wallet status. We learned in a recent survey among 1,000 U.S. cardholders that digital card controls in the banking app make the cardholder more likely to use the card as a default payment method. This has led to some banks going all-in with fully featured, integrated digital card solutions. Others, especially small to midsize banks, have asked their IT teams to implement some fundamental digital features as building blocks to their digital card platform – a foundation that can be enhanced and expanded by partnering with a digital card solution provider to offer cardholders a truly digital-first payment experience.

But financial institutions have different challenges when it comes to enabling intuitive yet secure digital payment options for their cardholders. The building blocks themselves, like choosing the right digital features, knowing which features are most requested by cardholders, and meeting the demands of different demographic groups, can be challenging to organize and understand. Similarly, it’s important to consider a solution that is scalable and future-proof to ensure the biggest ROI. Most IT teams have heavy resource constraints with a multitude of existing projects. Smaller financial institutions may find it difficult to build out their own digital card solution, while bigger institutions will think closely about the existing infrastructure in place. For example, by leveraging what they’ve already put in place and partnering with Entrust, a financial institutions’ IT team can answer the need for an even more digital and seamless customer experience.

Simplifying Digital Card Implementation

The Entrust Digital Card Solution is a single mobile software development kit (SDK) that’s easy to implement and opens a world of possibilities. The entire menu of capabilities becomes immediately available, but with the flexibility and scalability to pick and choose the right configuration for your customers at that point in time, adding more capabilities seamlessly as the organization’s payments enablement strategy evolves.

This innovative strategy shifts an IT team’s highly complex digital-first strategy to a unified and simplified integration for digital payments enablement. Our SDK or web service integration aims to create faster time to value with minimal intervention on behalf of IT. Our implementation helps IT teams overcome common challenges like internal resources among small departments, total cost of ownership across multiple features, and time to market.

Choosing a solution developed by experts focused on the digital card makes adding new integrations for the cardholder a much smoother, less time-intensive process. Ultimately, these specific capabilities enable IT teams to focus on mission-critical initiatives while promoting a fully integrated digital card solution.

To learn more about the Entrust Digital Card Solution, download our white paper and register for our webinar hosted by our financial issuance experts.