In a recent survey, we collected feedback from 1,000 consumers in the United States. The resulting report gives an extensive overview on the state of the American consumer regarding payment methods and how they prefer to interact with their financial institution.

Here are some key takeaways:

- Consumers trust credentials they can control and are able to access across channels.

- Digital card controls increase lift across physical and digital credentials.

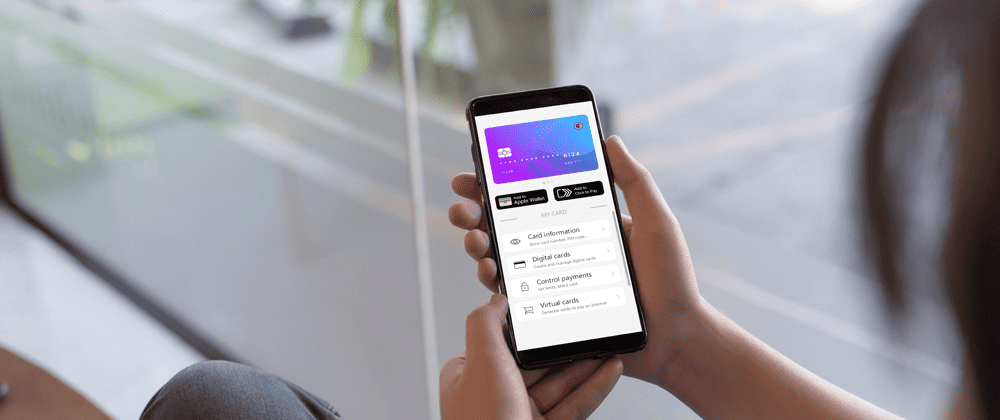

We discovered that if a financial institution offers their cardholders in-app card and transaction controls, like for example the ability to set a threshold for payments or the ability to disable a card, the card is more likely to sit “top of wallet” and to become the preferred payment for e-commerce transactions.

More specifically, 85% of respondents said card controls in the payment app would make them more likely to choose that card as their preferred payment method. App-based card and transaction controls help cardholders take control and manage their digital and physical cards without bank staff intervention. This self-service model brings tremendous value to cardholders in terms of convenience and efficiency across card formats and, in turn, drives lift for banks.

With card and transaction controls, cardholders have more control over:

- Their card: The cardholder can block and/or unblock their card.

- Their transactions: The cardholder can allow or disable different types of transactions, like contactless, e-commerce, or magstripe payments. They also get more control over their transactions thanks to threshold alerts that they can set, and they will be notified if the limit has been reached.

Card and transaction controls are a unique opportunity for banks, as well. They allow them to:

- Ensure their top-of-wallet status, both for physical and digital payment cards.

- Differentiate themselves from the competition by giving more power and self-service capability to the cardholder.

Additionally, for an extra level of security, card and transaction controls allow cardholders to deactivate lost or stolen cards via the bank’s application quickly and efficiently.

We recommend banks offer card and transaction controls that allow the cardholder to manage their card(s) on their own, via their bank app. In addition to enabling top-of-wallet status for the bank, these offerings also enhance the value proposition of the bank app itself. By enhancing the bank app with these digital card features, the app becomes the center of the relationship between the bank and the cardholder.

To learn more about U.S. consumer payment preferences, download this infographic.

To learn more about how the Entrust Digital Card Solution enables financial institutions to offer this level of control to their cardholders, visit:

https://www.entrust.com/issuance-systems/products/software/entrust-digital-card-solution