I must admit that I enjoy the convenience of e-commerce shopping. Grocery delivery is just incredibly convenient with my busy schedule. I value my time and want to make sure that I’m working smarter, not harder. But I sometimes find that the online payment process can take a while, especially if I do not feel comfortable storing my card details on merchant websites.

Consumer-preferred payment methods for e-commerce transactions are very dynamic and depend on the situation. So, to learn more about cardholder payment preferences, we recently surveyed 1,000 cardholders. We also asked the respondents how they typically complete an e-commerce transaction. We discovered that more than half of respondents (53%) indicated that they opt to either use the stored card on file or use an expedited checkout button for an easier checkout experience.

Providing the highest level of security for e-commerce payments is possible

Even though both methods are equally convenient for the cardholder, banks that provide the ability to use an expedited checkout button are providing an additional layer of security. This is because the payment information can be tokenized, if the card is pushed to the provider from the bank app.

Thanks to tokenization, card numbers are replaced by encrypted tokens, bringing more security to consumers when it comes to using a digital card to pay. The token is linked to a specific use case and device; e.g., the token can only be used on merchant page x and only from device y. Meaning should the data become compromised, it will not be of use for the fraudster. Providing tokenization and token management capabilities can empower the cardholder with more security and self-service options. And security is a major concern for the cardholder, as we have seen in our recent survey.

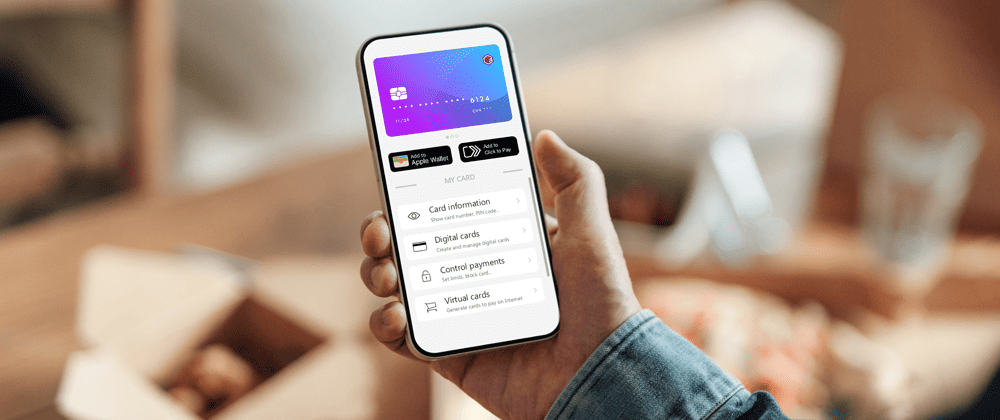

Banks can combine this with convenience: Expedited checkout buttons allow the consumer to pay faster online. While those options are proposed by the merchants, banks can also offer an option to push provision cards to digital wallets like Apple Pay, Google Pay, Click to Pay, Amazon Pay, PayPal, etc. from the banking app. The advantage is that the cardholder does not have to store the card information on file, and it is faster and more secure than typing in the actual PAN/card info on the merchant website.

Contactless payment and accelerated e-commerce checkout experiences will drive the next evolution in consumer payments, and banks will need to jump on the bandwagon if they want to stay competitive.

Entrust offers push provisioning to third-party wallets, and we now also offer push provisioning to Click to Pay for seamless and accelerated e-commerce checkout while providing the highest level of security. Click to Pay, and the enrollment from the banking app, gives cardholders the benefit of a seamless e-commerce checkout experience. This video shows how the enrollment and payment experience works with Click to Pay.

While physical payment cards remain preferred for in-person transactions, Click to Pay will reignite competition in the virtual checkout lane. Banks should consider offering a seamless payment portfolio, offering both digital and physical payment options.

Download the infographic of our recent report here. https://go.entrust.com/quick-pulse-survey-infographic