Card payments are more and more evolving from traditional old physical EMV payment cards to new Digital Cards or Tokens, thanks to the new schemes Tokenization systems (Visa VTS, Mastercard MDES, Cartes Bancaires CB Digital Hub,…). It is now a market standard for Card Issuers to onboard schemes tokenization systems. It enables the digitization of their card portfolio for wallets and e-commerce merchants and brings more security to card payments (replacing card numbers by non-sensitive tokens). But moving from physical cards to digital ones raises the question for card-holders to have a consolidated view and control all of their digital cards stored into different e-commerce merchants and NFC wallets.

How can I know that I saved my cards into different e-commerce merchants or wallets? How can I control, delete them in a simple and seamless way?

To answer that urgent need, Entrust is now introducing to the market its new Token Manager solution.

Entrust Token Manager enables banks to bring more convenience and self-care to users’ card management through the bank app by offering an effective solution for the user.

Dealing with the complexity of tokenization for issuers, Entrust Token Manager comes as a PCI DSS Visa VTS, Mastercard MDES and CB certified platform, either as:

- an add-on to Entrust Issuer Tokenization Hub (iTSP Hub)

- or as a complementary solution on top of the bank processor connectivity to VTS/MDES/CB.

API integration for any card scheme and use cases

Already certified Apple Pay, the Token Manager manages PAN encryption for Apple Pay Push provisioning for several banks in a multi-scheme way with complex architectures (Multi-CMS and processors).

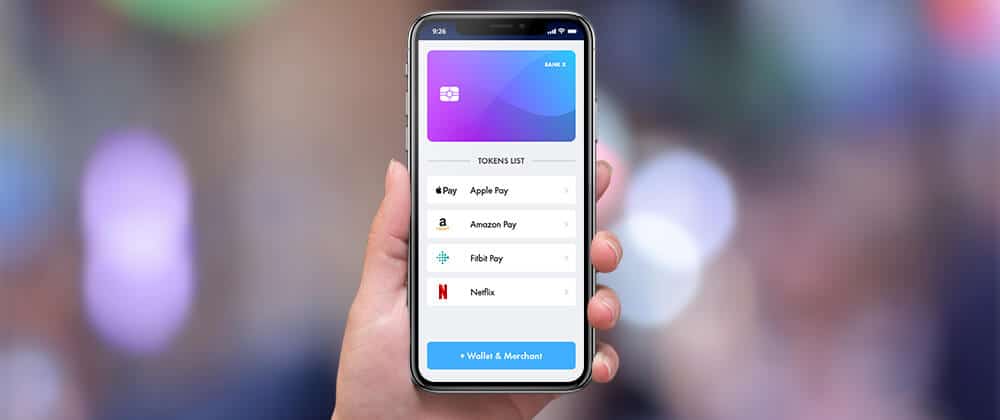

Entrust Token Manager APIs allow any card-holder to:

-

Get the list of digital cards (tokens) attached to its cards and get more information on tokens (use case name, device type…)

-

Push any card into any use case (eg. a user pushes its card into Apple Pay or Amazon directly from Bank app as already authenticated by its bank)

-

Control its digital card for any use case (eg. suspend, resume, delete user’s card into Apple Pay or its subscription from Amazon directly from the bank app)

-

Update token automatically when a primary card is replaced, stolen or lost, and associate existing token with new card (PAN)

Example of Entrust Token Manager API integration

Thanks to Entrust Token Manager, any cardholder will be able to have a secure and unique digital banking experience to manage cards.

Banks will transform their banking app into a state-of-the-art customer engagement tool with a secure user interface (UI) that can be adapted to banks’ graphic charter. It can also adapt to existing card systems of banks bringing innovation and flexibility. Token Management creates a new system : a natural extension of the existing Card Management System of banks, with limited to no-impact on their existing infrastructures.

Banks can deploy Entrust Token Manager in a few weeks through simplified API integration. Antelop PCI-DSS platform, certified Visa VTS, Mastercard MDES and CB, relies on leading security mechanisms and end-to-end encryption with GDPR compliancy.

Entrust already provides certified Visa, Mastercard, CB issuer tokenization platform (Entrust iTSP) enabling banks to have:

Simplified Digital Payments

-

Unified APIs launch of Apple Pay/Google Pay/Bank Pay (incl. SDK) and e-commerce tokens

-

Advanced Token Management; a unified way to push & control digital cards from bank app. into any use case (certified Apple Pay)

-

Secure display of sensitive card details from bank app (for virtual cards)

Strong Customer Authentication (SCA) with unique security and latest biometrics securing all mobile banking use cases (from credit transfers to 3DS e-commerce). Find out more about SCA here.

They talk about our Token Manager: Payments, Cards and Mobile shared a press release about our solution! You can also find more information in this article by Mobile Payments Today.

More than 30 banks already trust Entrust for digital card innovation. Thanks to its collaborative DNA and technical expertise Entrust enables them to accelerate digital transformation.